Kofax, Perceptive and Hyland reshuffle the deck in search of new winnings

Companies that grow by acquisition can be difficult to understand, particularly if lots of different products are bought from multiple sources over a sustained time period. (Take OpenText, for example.) Lexmark Enterprise Software is one such company, having taken several steps to get into–and now out of–enterprise software. With Lexmark International itself under new ownership, the company has decided, full stop, to abandon its quest to become a major enterprise content management (ECM) software vendor. This decision has given Thoma Bravo, Kofax and Hyland a chance to reshuffle their decks in search of new ECM winnings.

Lexmark’s exit from the software business is straightforward, but Perceptive Software and Kofax are, in many ways, just beginning to play another round in ECM and BPM. And, Lexmark’s decision to sell off assets to a private equity firm has created a bit of a wild card for Hyland, historically a very stable ECM/BPM company with a single unified platform and a new, cloud-based EFSS product. Why? Because Hyland will soon have a new product portfolio from Lexmark to absorb.

Here are the three big highlights from Lexmark’s sale of its software business to Thoma Bravo, a private equity firm:

- Kofax, part of Lexmark Enterprise Software, will be a separate company owned by Thoma Bravo once the sale closes, most likely in Q3 2017.

- ReadSoft, which had been integrated into Lexmark Enterprise Software over the past 2 years, will be combined with Kofax under the Kofax banner once the Lexmark/Thoma Bravo deal is finalized.

- The Perceptive Software portfolio, also part of Lexmark, will be sold to Hyland Software (also owned by Thoma Bravo) when the deal closes.

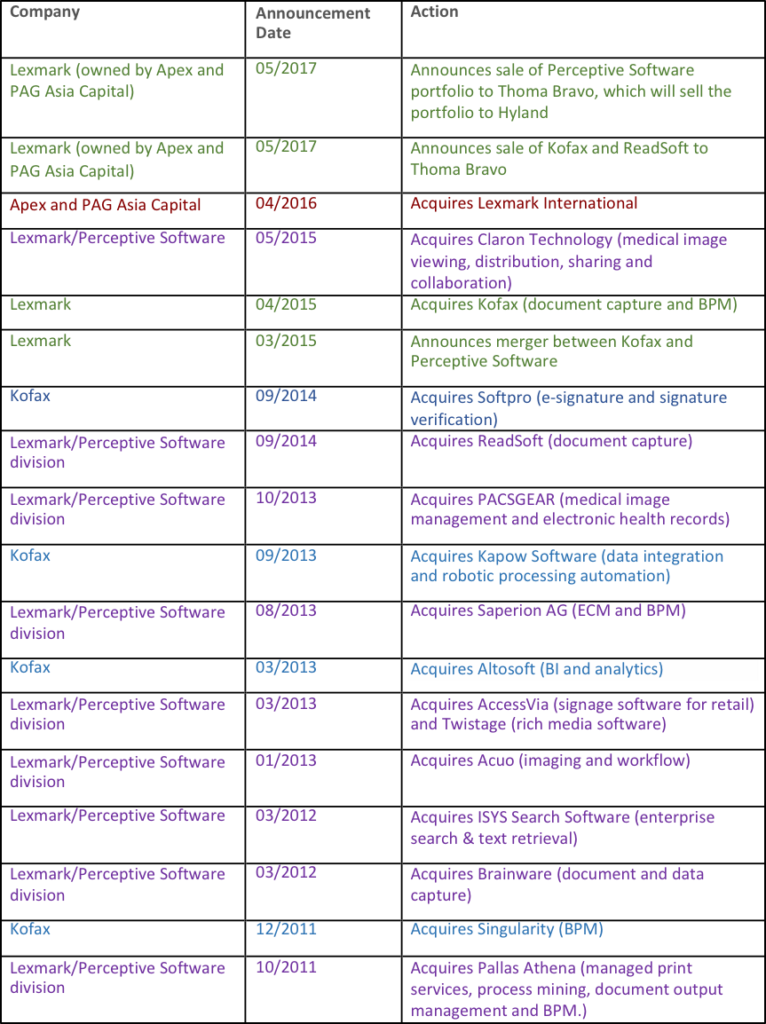

It may be hard to follow the details of this sale because two of the three key players (ReadSoft and, Kofax) are both fairly recently acquired companies themselves, as well as being the acquirers of several other companies. And Perceptive Software, acquired by Lexmark in 2010, has also grown through acquisition. The following timeline (Table 1) documents the history of Lexmark and its software companies:

Table 1: Lexmark Enterprise Business seeks to reshuffle the ECM deck, 2010-2017

It’s not surprising if this whirlwind of acquisitions since 2010 leaves you trying to figure out what is going on. This is a classic example of a hardware company (Lexmark) trying to buy its way into a (possibly) potentially synergistic software market without investing large amounts of time and money on R&D and new product development. It’s also a good example of why buying your way into an ECM market may not be such a good idea, particularly for a division like Perceptive Software, which is a loose confederation of software piece parts.

Kofax is Well-Positioned for Operational Processes Using BPM and Case Management

Throughout it all, Kofax has stayed focused on a few select ECM markets where it could differentiate against competitors, and where it could easily integrate complementary acquisitions into its core offering. Those inter-related ECM markets are:

- business process management (delivered through the Singularity acquisition)

- case management (also through Singularity)

- document capture (this was Kofax’s core market for many years and was substantially bolstered by the ReadSoft acquisition)

- robotic processing automation, also known as RPA (delivered through the Kapow acquisition)

- document output management (provided through the AiA acquisition in 3/2015)

Having just returned from Kofax’s Inspire conference where I was briefed by multiple product marketing executives, I’m confident these products will drive Kofax’s future ECM success in its five target markets. In many ways, these separate markets are either converged or converging. For example, BPM and case management uses many of the same process components, and RPA is a strong enhancement to BPM and case.

What about content management? Will it hurt Kofax to lose the content capabilities from Perceptive Software? Initially, I thought so, but the answer is, not really. First, Kofax’s case management and BPM product includes a native repository that retains documents throughout the business process, and integrates with third-party products, such as Microsoft SharePoint, ERP and CRM solutions. Second, it was pretty clear at Inspire that the product integration between Kofax and Perceptive Software is not deep. Third, customers from the two divisions didn’t seem to know a lot about the others’ products and were trying to learn more about the other divisions at Inspire. This indicates that cross selling between the two customer bases is not high. So it won’t hurt Kofax to untangle from Perceptive.

For example, Kofax shines in operational, back office processes and in complex case handling processes. Companies seeking solutions for these processes typically include organizations from financial services, insurance, health care, government and other document-intensive operations. In contrast, the Perceptive Software installed base is largely health care and higher education, the latter of which has not been heavily penetrated by Kofax. Of course, cross-selling and product integration opportunities existed, but appear to be missed opportunities. Now, that’s turning into an advantage because losing the Perceptive Software portfolio to Hyland will most likely not hurt Kofax. Instead, Kofax will continue to be well-positioned in transactional content, case management, BPM, complex document capture, mobile capture, document output, and robotic process automation (RPA).

Perceptive creates a new deck for Hyland with a strong industry focus

Perceptive Software and Hyland are quite different when it comes to product DNA. Perceptive is a roll-up of many (10+) acquisitions while Hyland prides itself on a single product that was built natively (instead of through acquisition) and exists on a single code base. I recently got two in-depth product briefings from Hyland about its ECM, BPM and case management strategy, and was struck by how often the product managers would comment on the single platform that they sell into multiple markets. Hyland’s marketing staff emphasized this point repeatedly, and stressed how the company’s organic product development is a major competitive advantage. For example, the Hyland OnBase repository natively supports these markets:

- Imaging

- Knowledge management (KM)

- Enterprise content management (ECM)

- Document capture

- Business Process Management (BPM)

- Case management

The only exception to this common platform is the Hyland electronic file synch and share (EFSS) product, which is a new, cloud based offering largely targeted at state and local government agencies.

Details surrounding Hyland’s pending purchase of Perceptive Software are unavailable because Hyland cannot comment until the deal closes (expected in Q3.) However, Table 1 reveals the many DNA threads that Perceptive Software comprises. This hints at the challenge Hyland may have when weaving the new components and its corporate positioning into a cohesive whole, particularly given its emphasis on Hyland’s single, unified platform. The Perceptive sale includes all Perceptive products, such as Perceptive Intelligent Capture, Acuo VNA, PACSGEAR and Enterprise Medical Image Viewing.

Four key outcomes will most likely result from Hyland’s purchase of the Perceptive Software portfolio:

- PACSGEAR and Enterprise Medical Image Viewing will be targeted at health care providers, helping to deepen Hyland’s vertical go-to-market approach.

- Perceptive Intelligent Capture will be integrated into the native Hyland product line.

- Other components from Perceptive’s portfolio could be sold separately or used to drive OEM sales.

- Hyland will continue to emphasize its natively developed, single platform as a core differentiator against competitors that have grown through acquisition.

Summary

Lexmark’s decision to get out of the software business is not a surprise. The handwriting was on the wall, as soon as Lexmark was bought by an Asian printer conglomerate a year ago. The biggest question mark then was where Lexmark’s software divisions—Kofax and Perceptive Software—would end up. Everyone wondered, would they be yet another platform for OpenText to integrate or would some other suitor step in? But the final suitor was a private equity firm. Thoma Bravo will look to cut costs, operate the companies more efficiently than before and find synergies across the products that it has purchased–while also investing in technology and accretive acquisitions to increase revenues. The firm will most likely quickly sell assets that do not clearly enhance Hyland or Kofax’s product revenue. Now and over the long term, expect:

- Kofax to focus on its core markets

- Hyland to leverage the Perceptive portfolio in vertical markets without diluting or damaging its core competitive message of a native, unified single ECM/BPM/case platform.