Voice is Dead. Long live Non-Voice.

Since 2010 the sale of voice-related technology for the contact center has seen a steady decline. This has forced the contact center and voice vendors such as Avaya, Interactive Intelligence, Cisco, Nuance, Genesys and others to explore different growth strategies in order to keep shareholders happy. The typical choices these vendors made was to start playing in the cloud contact center space; add non-voice related channels such as live chat, knowledge management, etc. or add workforce optimization capabilities.

The contact center as a service (CCaaS) market has seen several challenges with the biggest one being the ability to handle large volumes of calls. Except for Interactive Intelligence and Genesys, the CCaaS market has mostly seen new entrants such as Five9; InContact; LiveOps; 8×8 and others coming to the fore and has, therefore, not been the saving grace it was made out to be. Another strategy had to be explored and so voice service providers turned to workforce optimization.

Voice providers will seek other strategies

The workforce optimization (WFO) market has long been led by Verint and Nice so it has been a difficult market to penetrate. The stalwarts such as Interactive Intellegence and Genesys added the WFO functionality piece-meal but competition is fierce with many new and old providers such as InContact, Calabrio, Zoom, and Aspect providing various components of WFO functionality in their offerings. Another strategy had to be explored so providers turned to Non-Voice.

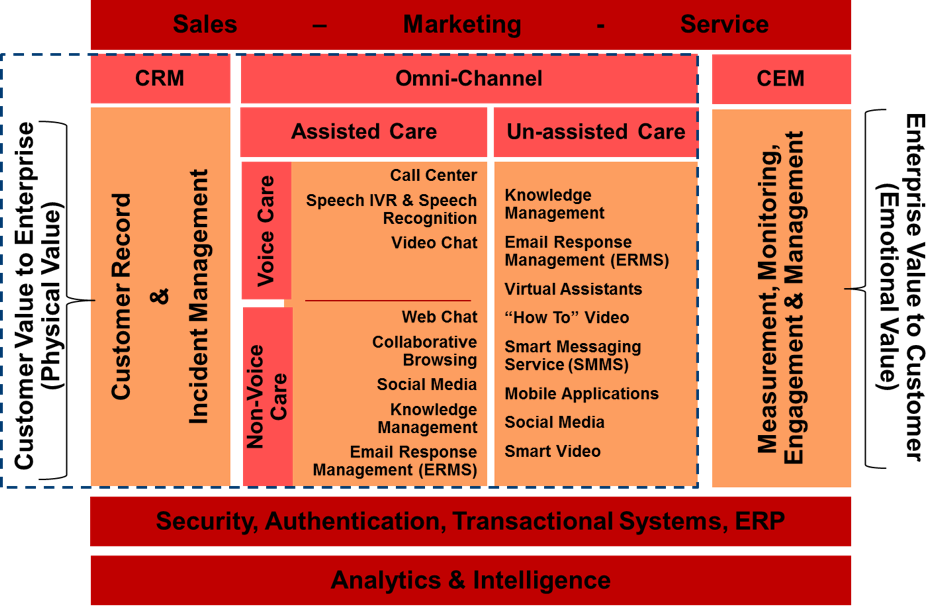

Non-Voice or omni-channel, as it is often referred to, consists of ten very specific and distinct channels of interaction and goes way beyond the concept of multi-channel. It consists of both assisted channels as well as unassisted channels and can be represented as follows:

For more information, see my Customer Care Framework previously published by Digital Clarity Group.

It is a well-published fact that the customer of today (and the future) is looking for instant service in the channel that they find themselves at that time. It is, therefore, unsurprising that the non-voice market is where the most growth is forecasted with the channels of social, web chat and knowledge for self-service leading the sales figures.

Watch for non-traditional challengers

What is interesting to note is that many vendors that are traditionally not seen as contact center vendors are aggressively attacking the market with resounding success. Oracle’s acquisition of the vendor, RightNow Technologies, is one such example. Salesforce.com has followed a different approach and over time bought a number of vendors including GoInstant (collaborative browsing), Activa (live chat), and Instranet (knowledge management). Other vendors such as Interactive Intellegence, Genesys and even SAP have invested millions of dollars and, with the exception of knowledge management, have built their channels.

When looking at the contact center business process outsourcing market (BPO) there has been a significant shift in the makeup of the BPO interactions between voice and non-voice based billings. Organizations such as Atento, Teleperformance, Convergys, TeleTech and others are reporting up to 30% of their interactions being non-voice compared to 5 – 10% only five years ago.

Nuance makes key acquisitions

A key voice related vendor, Nuance, that have over the years slowly expanded their interactive voice response (IVR) solution to include human-assisted IVR, speech recognition IVR, speaker verification and voice biometrics and interaction analytics have also started expanding into the non-voice market. Its first foray was with the acquisition of the virtual assistant vendor, VirtuOz, after which it launched an exclusive mobile-based CRM application called Nina. Now Nuance has bought the non-voice vendor called TouchCommerce that supports web, mobile and social commerce interactions with in-channel services such as web chat and product related knowledge.

Digital Clarity Group has monitored the accelerating growth of non-voice and predict that soon the few remaining non-voice vendors such as eGain and Moxie software will also be acquired to beef up the capabilities of the next provider looking to make an impact in the very lucrative world of non-voice.

Image courtesy of photographer Alan Clark via a Creative Commons license.